Solar power is gaining traction among Canadian businesses for one simple reason—it makes financial sense. What used to be seen as a niche environmental move is now a smart investment strategy that reduces electricity costs and improves business resilience.

Energy costs in Canada fluctuate, and businesses that rely solely on the grid are vulnerable to price spikes. By generating your own power, you take control of your overhead expenses, allowing for more reliable budgeting and long-term cost stability.

But here’s the kicker: the Canadian government is offering major tax incentives to make switching to solar even more appealing. With the Clean Technology Investment Tax Credit (CTITC), incorporated businesses can get back up to 30% of the total cost of installing rooftop solar systems. That means lower upfront costs, faster returns, and long-term energy savings—without taking a financial hit.

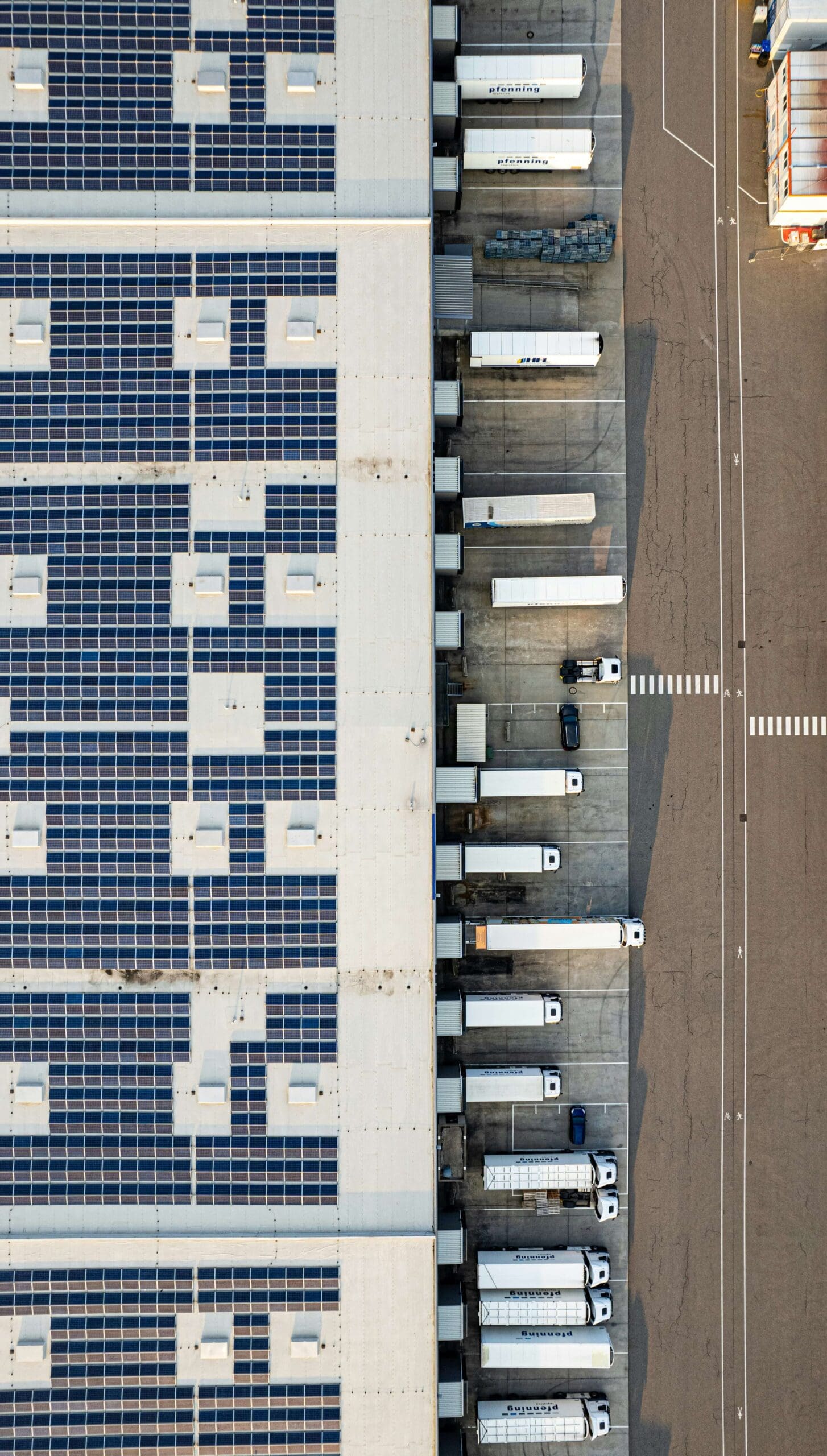

Beyond immediate savings, rooftop solar panels can significantly increase property value. Whether you own your office space, storefront, or warehouse, adding solar infrastructure enhances desirability, making the property more attractive to future buyers or tenants. Investors and tenants actively seek out energy-efficient spaces because they translate to lower utility costs and modernized infrastructure, meaning solar can be a powerful selling point down the line.

Additionally, businesses making the shift to solar power are in a stronger position to access new market opportunities and funding sources. More corporations and government agencies prioritize suppliers that demonstrate energy efficiency, and in some industries, being solar-powered can improve a company’s ability to bid on contracts.Whether you’re looking to improve efficiency, reduce expenses, or increase energy independence, now is the time to explore how solar incentives can work for you.

Business Owners Should Care About the CTITC for these 4 Reasons:

If you’re an incorporated business owner, this tax credit is more than just another government program; it’s a real opportunity to cut costs and make a smart financial move. Here’s why:

- Reduce Installation Costs: Claim back up to 30% on qualifying solar expenses

- Boost Property Value: Rooftop solar improves commercial space marketability and resale potential.

- Lower Long-Term Energy Bills: Gain control over electricity costs and shield yourself from rate hikes.

- Government-Backed Savings: This refundable tax credit provides direct financial returns, ensuring businesses reap the full benefits.

Across Canada, businesses are leveraging the CTITC to enhance energy resilience, lower costs, and future-proof their operations.

What is the Clean Technology Investment Tax Credit?

The Clean Technology Investment Tax Credit (CTITC) is a financial incentive designed to help Canadian businesses transition to renewable energy by making solar and battery investments more affordable. By offering refundable tax credits, the program ensures that businesses receive direct financial relief, making it easier to retrofit or replace existing equipment without bearing the full cost upfront.

Whether it’s a rooftop solar system, battery storage, or other qualifying equipment, companies can leverage this tax credit to make long-term, cost-effective investments in clean power. With global energy markets becoming more volatile, the CTITC provides Canadian businesses with an opportunity to secure stable energy sources, reduce grid dependency, and improve financial predictability.

Key Details:

- Refundable Tax Credit – Businesses can claim up to 30% of eligible costs, directly lowering solar installation expenses.

- Applies to Incorporated Entities – The tax credit is available to incorporated businesses, meaning sole proprietors may not qualify.

- Focus on Clean Energy – Covers rooftop solar panels, battery storage systems, and certain related equipment essential for clean energy adoption.

- Immediate Financial Relief – Helps businesses offset the high upfront cost of solar installations, making clean technology investments more accessible.

By taking advantage of the CTITC, companies can modernize their energy use, improve energy independence, and buffer themselves from electricity price volatility.

Who Qualifies for the Clean Technology Investment Tax Credit?

The CTITC is designed to support Canadian incorporated businesses as they transition to clean energy, helping offset the costs of solar power systems and related technologies. While sole proprietors and non-incorporated individuals may not qualify, registered corporations—whether mid-sized, small, or home-based—can take advantage of this incentive to lower upfront investment and secure long-term savings.

Mid-Sized Businesses: Scaling Solar for Greater Impact

For mid-sized companies, energy expenses can represent a significant overhead cost, making solar adoption a smart financial move. Whether operating a manufacturing facility, office building, or large retail space, businesses can utilize rooftop solar to reduce reliance on fluctuating electricity rates and reinvest savings into growth. The CTITC helps these businesses install larger solar setups and battery storage systems, ensuring stability and energy efficiency across multiple locations.

Small Businesses: Cutting Costs & Boosting Resilience

For small businesses, electricity costs can be unpredictable, especially as rates continue to rise. Many local shops, restaurants, and service providers operate in compact commercial spaces, making rooftop solar installations an excellent way to reduce expenses and achieve energy independence.

Battery storage plays a critical role in ensuring small businesses stay operational during power outages or peak electricity rate periods, protecting essential services like refrigeration, digital transactions, and heating/cooling systems. The CTITC provides immediate financial relief, helping small business owners overcome the barrier of high upfront installation costs while securing long-term energy savings.

Solo Entrepreneurs & Home Offices: Making Solar Work for You

For business owners operating from home offices, rooftop solar is a strategic financial decision that can reduce costs and improve energy reliability. If the solar installation is classified as a business expense rather than a personal residential upgrade, you may be eligible to claim the Clean Technology Investment Tax Credit (CTITC), even as a solo entrepreneur or small-scale business owner.

While home-based businesses often have lower energy consumption compared to larger companies, the savings from solar adoption add up significantly over time, reducing monthly electricity bills and creating a stable energy environment. Freelancers, consultants, and remote professionals who rely heavily on internet connectivity, cloud-based software, and tech-heavy workstations benefit greatly from solar power. Pairing rooftop solar with battery storage ensures uninterrupted productivity, even during grid failures or extreme weather events, preventing costly downtime.

Additionally, businesses with specialized energy needs, such as design studios, private medical practices, and digital media creators, require consistent power availability to keep operations running smoothly. Whether you use high-powered creative tools, medical equipment, or data-intensive applications, solar and battery storage offer long-term stability and cost efficiency.

By leveraging the CTITC, even small, home-based businesses can make solar energy a financially viable solution, transforming how they manage expenses and maintain operational resilience. As electricity rates continue to rise, taking control of your power source through solar investment positions solo entrepreneurs for greater savings, stability, and energy independence.

Basic Eligibility Checklist

- Your business is incorporated – Sole proprietors may not qualify.

- You’re investing in qualifying rooftop solar systems – The CTITC supports solar panels, battery storage, and select related equipment.

- Your project aligns with clean technology guidelines – Ensure compliance with government standards for renewable energy adoption.

Regardless of size, incorporated businesses across Canada can take advantage of the CTITC to lower their energy costs, increase resilience, and future-proof their operations with clean technology investments.

To be sure your business qualifies, consult a tax professional or review the official government guidelines.

Financial Benefits of Using the CTITC for Rooftop Solar

Beyond just tax savings, rooftop solar provides a strategic financial advantage that extends well beyond a one-time credit. From reducing operational expenses to enhancing property value, businesses that invest in solar can secure long-term financial stability while future-proofing against rising energy costs.

1. Lower Operating Costs

Electricity is one of the largest overhead expenses for businesses. By installing rooftop solar, companies generate their own power, significantly reducing reliance on the grid. This translates into lower monthly utility bills, allowing businesses to free up capital for expansion, equipment upgrades, or workforce growth. Additionally, solar battery storage ensures continuous power availability, further minimizing disruptions and inefficiencies caused by blackouts or fluctuating utility rates.

2. Protection Against Rising Utility Rates

Canadian electricity rates continue to increase year over year, making long-term budgeting a challenge for businesses dependent on traditional power sources. With solar, businesses gain control over energy expenses, insulating themselves from unpredictable price hikes. This financial stability allows companies to forecast future costs more accurately, ensuring better long-term planning and resource allocation.

3. Competitive Edge

Businesses with lower energy costs have more flexibility to reinvest in operations, scale production, and improve service offerings. Whether it’s lowering overhead, investing in R&D, or expanding product lines, solar adoption frees up funds that would otherwise be spent on rising utility bills.

4. Increased Property Value

Commercial buildings equipped with solar panels often see an increase in market value, attracting buyers and tenants looking for energy-efficient properties. Rooftop solar installations make businesses more desirable due to lower operating costs, making commercial spaces stand out in competitive real estate markets. Additionally, government incentives like the CTITC further boost investment appeal, making solar-powered properties a premium asset for both owners and lessees.

5. Enhanced Energy Resilience & Stability

Beyond financial savings, rooftop solar combined with battery storage provides businesses with energy independence, ensuring continuous operation during grid outages or emergencies. Whether dealing with extreme weather, supply disruptions, or power failures, solar-equipped businesses maintain reliable electricity access, preventing costly downtime and safeguarding operations.

By leveraging the CTITC, businesses of all sizes can minimize energy expenses, improve financial predictability, and increase long-term profitability.

How to Take Advantage of the CTITC for Rooftop Solar

Leveraging the Clean Technology Investment Tax Credit (CTITC) is a strategic financial move that allows businesses to transition to solar while benefiting from government-backed savings. By following these steps, businesses can ensure their solar investment is eligible, financially rewarding, and seamlessly integrated into operations.

Step 1: Choose a Qualified Solar Provider

Not all solar systems qualify for the CTITC. To maximize your savings and ensure eligibility, it’s crucial to work with a trusted provider, like GreenKey, that specializes in government-approved solar installations. An experienced provider will help determine the right system size, technology type, and compatibility with your business needs, ensuring you install a setup that meets official guidelines.

Additionally, selecting a reputable solar installer ensures access to high-quality equipment, long-term maintenance support, and expert recommendations on optimizing energy storage solutions. Businesses should inquire about certifications, warranties, and past customer experiences to ensure they’re choosing a provider that aligns with their goals.

Step 2: Verify Eligibility

Before committing to an installation, businesses should consult a tax professional to confirm eligibility and calculate potential savings. Because the CTITC is designed for incorporated businesses, sole proprietors and non-incorporated individuals may not qualify. However, if you operate a corporation or registered entity, you may be able to claim up to 30% of eligible costs as a refundable tax credit.

Working with a financial expert can also help maximize deductions, ensuring businesses take advantage of all available benefits while remaining compliant with regulations. Additionally, reviewing official government guidelines ensures businesses understand qualifying solar components, installation requirements, and filing processes before making financial commitments.

Step 3: Install a Solar System That Meets Government Criteria

After confirming eligibility, businesses must install a solar setup that aligns with government standards to qualify for the CTITC. The system must be designed for business use, meaning residential installations or personal-use solar setups may not be covered.

GreenKey’s team can assist in selecting the best quote with the most efficient rooftop solar panels with battery storage systems or grid-tied solutions that meet the criteria for tax credit eligibility. Working with an installer experienced in commercial solar systems ensures seamless integration with business operations, helping companies optimize energy production while maintaining compliance with government incentives.

Step 4: Claim Your Tax Credit

Once the solar system is installed and operational, businesses can file for the Clean Technology Investment Tax Credit (CTITC) on their corporate tax return. The accounting team or tax consultant can assist with documentation, ensuring all relevant expenses are properly recorded for submission.

Additionally, businesses should retain installation records, receipts, and proof of system qualifications to streamline the filing process and prevent complications during tax assessments. Since the CTITC is a refundable tax credit, eligible businesses receive direct financial returns rather than just deductions, making this program a powerful tool for reducing investment costs.

Other Federal Incentives for Business

Canada offers several tax incentives to encourage investment in clean energy technologies, helping businesses and individuals reduce costs and improve financial returns. Two key programs are the Accelerated Capital Cost Allowance (ACCA) and Canadian Renewable and Conservation Expenses (CRCE), both of which provide valuable tax benefits that support solar, wind, battery storage, and other renewable energy projects.

Accelerated Capital Cost Allowance (ACCA)

The Accelerated Capital Cost Allowance (ACCA) is a Canadian tax incentive designed to encourage investment in clean energy technologies by allowing businesses and individuals to depreciate eligible assets at an accelerated rate. This means that instead of spreading tax deductions over several years, investors can claim a larger portion upfront, reducing taxable income and improving cash flow efficiency.

How ACCA Supports Clean Energy Investment

ACCA applies to assets classified under Classes 43.1 and 43.2, which include technologies like:

- Solar photovoltaic systems

- Battery storage solutions

- Wind energy equipment

- Geothermal energy systems

By allowing faster depreciation of these assets, ACCA helps businesses and homeowners recoup costs sooner, making clean energy investments more financially attractive.

Canadian Renewable and Conservation Expenses (CRCE)

CRCE provides an additional tax advantage by allowing certain intangible costs, such as feasibility studies, environmental assessments, and pre-construction development expenses, to be treated as Canadian Exploration Expenses (CEE). This designation makes them eligible for tax deductions and flow-through share agreements, enhancing investment potential.

Key Features of CRCE:

- Eligible Expenses: Covers costs related to renewable energy and energy efficiency projects, including feasibility studies, environmental assessments, and engineering work.

- Flow-Through Shares: Businesses can renounce CRCE expenses to investors, allowing them to deduct these costs from taxable income.

- Class 43.1 & 43.2 Assets: At least 50% of project costs must involve equipment eligible for Class 43.1 or 43.2 capital cost allowance (CCA) treatment.

- Eligible Technologies: Includes wind turbines, solar panels, geothermal systems, biomass energy, and small hydroelectric facilities.

For more details, refer to the Technical Guide to CRCE or the Canada Revenue Agency’s CRCE page.

Maximizing Tax Benefits

For businesses investing in rooftop solar, battery storage, or other clean energy technologies, leveraging multiple tax incentives can significantly reduce costs and improve long-term financial outcomes.

- ACCA allows for faster depreciation of equipment, improving cash flow and return on investment.

- CRCE enables businesses to deduct development expenses while utilizing flow-through share agreements to attract investors.

By strategically combining ACCA and CRCE, businesses can reduce their tax burden, accelerate payback periods, and enhance financial stability in their renewable energy projects. Investors should consult tax professionals or refer to Canada Revenue Agency (CRA) guidelines to ensure they maximize deductions and credits efficiently.

Frequently Asked Questions

Is this the same as other solar incentives?

No—this is a refundable tax credit, meaning businesses get money back, unlike simple deductions.

Do I need special financing?

Not necessarily. Some businesses pay upfront, while others use solar financing plans alongside tax incentives.

Will solar panels work in Canada’s climate?

Absolutely. Modern solar technology performs well even in colder climates, including snowy regions.

Why Now is the Time for Businesses to Invest in Rooftop Solar

Canada’s Clean Technology Investment Tax Credit (CTITC) is transforming the way businesses approach clean energy investments, offering financial incentives that significantly lower the upfront costs of going solar. But beyond the tax savings, investing in rooftop solar now means businesses can future-proof operations, improve sustainability, and secure long-term financial benefits.

Government-Backed Savings Like Never Before

The CTITC provides a refundable tax credit, returning up to 30% of qualifying solar installation costs directly to businesses. Unlike traditional tax deductions, this credit offers immediate financial relief, ensuring businesses see tangible savings right away. Businesses that act now stand to benefit from the maximum available incentives before policy changes or funding limits alter program availability.

Lower Upfront Costs Make Solar More Accessible

Historically, the high initial investment required for solar adoption has been a barrier for many businesses. But with the CTITC in place, this obstacle is fading fast. Businesses can now install high-efficiency solar panels and battery storage at a fraction of the cost, allowing for quicker returns and improved energy savings. Pairing solar with battery storage ensures stability, protecting operations from grid outages and fluctuating electricity rates.

The Competitive Edge: Lower Costs, Greater Sustainability

Energy costs continue to rise across Canada, but businesses that invest in solar lock in long-term savings, shielding themselves from unpredictable utility rate hikes. What does this mean? Lower overhead costs, improved profit margins, and greater reinvestment opportunities, whether in expanding operations, hiring new employees, or enhancing services. Additionally, sustainability has become a major factor in consumer choices, meaning businesses that embrace clean energy not only cut costs but also strengthen their brand reputation and market appeal.

A Solar-Powered Future is Already Here

Businesses across Canada, from corporate offices to local shops, are already seeing the benefits of rooftop solar. Energy independence, cost stability, and long-term financial growth are no longer distant goals; they’re realities that forward-thinking businesses are achieving today.

There has never been a better time to invest in rooftop solar. With government incentives, lowered costs, and long-term advantages, businesses that act now secure financial stability and a competitive edge for the future.